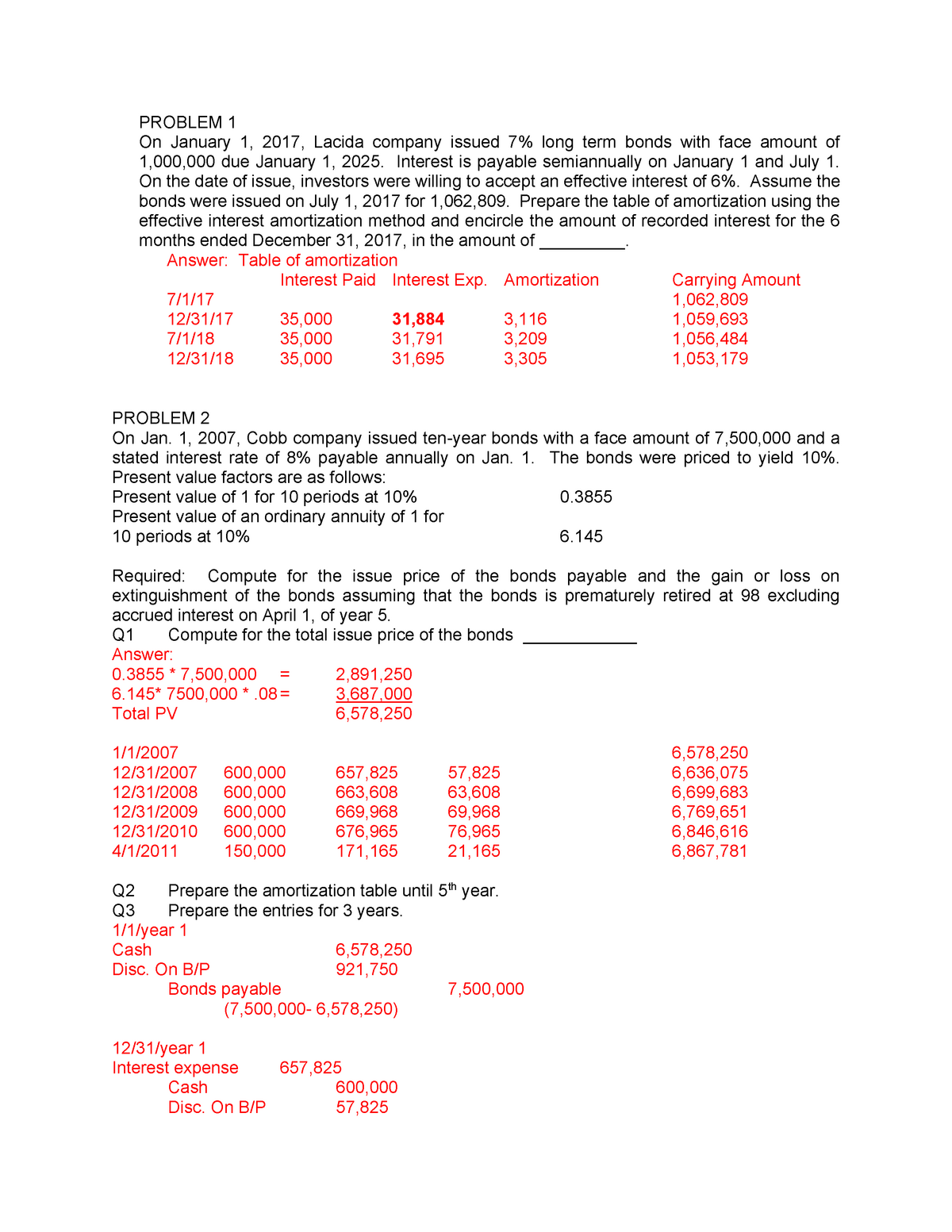

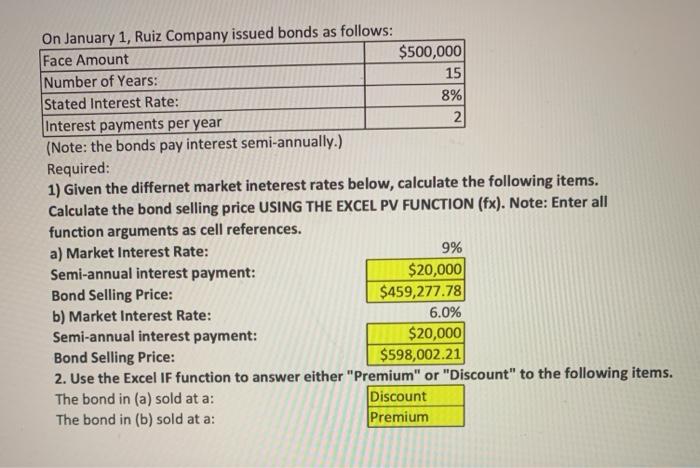

Jan 21, 2023On January 1. Ruiz Company issued bonds as follows: Face Value: Number of Years: Stated Interest Rate: Interest payments per year 500,000 15 7% Required: 1)

Setting Up a Hospital in India. Investment Opportunity in Healthcare Industry. Start a Hospital in India. | PPT

Use the. Ruiz Company issued bonds on January 1 and has provided the relevant information. The Controller has asked you to calculate the bond selling price given two different market interest rates using Excel’s Present Value functions. Use the information included in the Excel Simulation and the Excel functions described below to complete

Source Image: studocu.com

Download Image

Bonds with a face value of P5,000,000 carrying a stated interest rate of 12% payable semiannually on March 1 and September 1 were issued on July 1. The total proceeds from the issue amounted to P5,200,000. The best explanation for the excess amount received over the face value is that A. the bonds were sold at a premium. B. the bonds bear an

![Solved] On January 1. Ruiz Company issued bonds a | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/02/601a4a7b4054d_1612335735442.jpg)

Source Image: solutioninn.com

Download Image

Solved] Ruiz Company issued bonds on January 1 and has provided the… | Course Hero Image transcription text. On January 1, Ruiz Company issued bonds as follows: Face Amount: $500,000. Number onears: 30 Stated Interest Rate: 7% Interest payments per year 2 Note: The. bonds pay interest semiannuofly.

Source Image: chegg.com

Download Image

On January 1 Ruiz Company Issued Bonds As Follows

Image transcription text. On January 1, Ruiz Company issued bonds as follows: Face Amount: $500,000. Number onears: 30 Stated Interest Rate: 7% Interest payments per year 2 Note: The. bonds pay interest semiannuofly. On January 1, Ruiz Company issued bonds as follows: Face value: $500,000; Number of years: 30; Stated interest rate: 7%; Interest payments per year: 2. Note: The bonds pay interest semiannually. a) Calculate the semiannual interest payment. b) Determine the total interest paid over the life of the bonds. c) Find the present value of the bonds.

Solved On January 1, Ruiz Company issued bonds as follows: | Chegg.com

On January 1, Ruiz Company issued bonds as follows: FV – C3 # of Yrs – C4 Stated Insurance Rate – C5 Interest Payments/Yr – C6 Calculate the bond selling price given the two market interest rates below. Solved] Ruiz Company issued bonds on January 1 and has provided the… | Course Hero

Source Image: coursehero.com

Download Image

Ewa Juszkiewicz | Interview | Gagosian Quarterly On January 1, Ruiz Company issued bonds as follows: FV – C3 # of Yrs – C4 Stated Insurance Rate – C5 Interest Payments/Yr – C6 Calculate the bond selling price given the two market interest rates below.

Source Image: gagosian.com

Download Image

Setting Up a Hospital in India. Investment Opportunity in Healthcare Industry. Start a Hospital in India. | PPT Jan 21, 2023On January 1. Ruiz Company issued bonds as follows: Face Value: Number of Years: Stated Interest Rate: Interest payments per year 500,000 15 7% Required: 1)

Source Image: slideshare.net

Download Image

Solved] Ruiz Company issued bonds on January 1 and has provided the… | Course Hero Bonds with a face value of P5,000,000 carrying a stated interest rate of 12% payable semiannually on March 1 and September 1 were issued on July 1. The total proceeds from the issue amounted to P5,200,000. The best explanation for the excess amount received over the face value is that A. the bonds were sold at a premium. B. the bonds bear an

Source Image: coursehero.com

Download Image

Mbappe scores hat-trick as PSG beat Reims to go on top of Ligue 1 – PUNE.NEWS Nov 1, 2023answered Ruiz Company issued bonds on January 1 with a face value of $500,000, a stated interest rate of 7%, and interest payments made semiannually. Calculate the bond selling price using the Excel PV function with a market interest rate of 9%. a) Premium b) Discount c) $500,000 d) $545,400 Advertisement popemichael121 is waiting for your help.

Source Image: pune.news

Download Image

Does shrub encroachment reduce foraging grass abundance through plant-plant competition in Lesotho mountain rangelands? [PeerJ] Image transcription text. On January 1, Ruiz Company issued bonds as follows: Face Amount: $500,000. Number onears: 30 Stated Interest Rate: 7% Interest payments per year 2 Note: The. bonds pay interest semiannuofly.

![Does shrub encroachment reduce foraging grass abundance through plant-plant competition in Lesotho mountain rangelands? [PeerJ]](https://dfzljdn9uc3pi.cloudfront.net/2022/13597/1/fig-2-2x.jpg)

Source Image: peerj.com

Download Image

Occupancy of wild southern pig-tailed macaques in intact and degraded forests in Peninsular Malaysia [PeerJ] On January 1, Ruiz Company issued bonds as follows: Face value: $500,000; Number of years: 30; Stated interest rate: 7%; Interest payments per year: 2. Note: The bonds pay interest semiannually. a) Calculate the semiannual interest payment. b) Determine the total interest paid over the life of the bonds. c) Find the present value of the bonds.

![Occupancy of wild southern pig-tailed macaques in intact and degraded forests in Peninsular Malaysia [PeerJ]](https://dfzljdn9uc3pi.cloudfront.net/2021/12462/1/fig-1-2x.jpg)

Source Image: peerj.com

Download Image

Ewa Juszkiewicz | Interview | Gagosian Quarterly

Occupancy of wild southern pig-tailed macaques in intact and degraded forests in Peninsular Malaysia [PeerJ] Use the. Ruiz Company issued bonds on January 1 and has provided the relevant information. The Controller has asked you to calculate the bond selling price given two different market interest rates using Excel’s Present Value functions. Use the information included in the Excel Simulation and the Excel functions described below to complete

Solved] Ruiz Company issued bonds on January 1 and has provided the… | Course Hero Does shrub encroachment reduce foraging grass abundance through plant-plant competition in Lesotho mountain rangelands? [PeerJ] Nov 1, 2023answered Ruiz Company issued bonds on January 1 with a face value of $500,000, a stated interest rate of 7%, and interest payments made semiannually. Calculate the bond selling price using the Excel PV function with a market interest rate of 9%. a) Premium b) Discount c) $500,000 d) $545,400 Advertisement popemichael121 is waiting for your help.