Jul 8, 2022Banks and credit unions charge nonsufficient funds, or NSF, fees when you don’t have enough money in your account to process a transaction. NSF fees can add up quickly, so it’s important to take steps to avoid them. Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors

UOB One Account (Savings Account) Review 2023 – MoneySmart Blog

Jun 14, 2022The APR (which is the same as your interest rate) will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300. You see a non-sufficient funds (NSF) fee on your bank statement.

Source Image: lendingpot.sg

Download Image

May 1, 2023You haven’t opted-in to overdraft protection, so the check bounces and your bank charges you $34 — the average cost of an NSF fee. Your account balance is now $66 ($100-$34). Let’s look at the

Source Image: linkedin.com

Download Image

Different Types Of Bank Accounts | PDF NSF Checks on a Credit Report July 17, 2016 • 2 min read By The Experian Team Dear Experian, How long do non-sufficient funds checks (NSF’s) stay on your credit report? – LLS Dear LLS, A non-sufficient funds check may not appear on your credit report.

Source Image: reddit.com

Download Image

Nsf Results In A Bank Crediting One’S Account

NSF Checks on a Credit Report July 17, 2016 • 2 min read By The Experian Team Dear Experian, How long do non-sufficient funds checks (NSF’s) stay on your credit report? – LLS Dear LLS, A non-sufficient funds check may not appear on your credit report. Sep 28, 2023NSF fees are charges when a payment can’t be processed because you don’t have enough money in your account. If your bill can’t be paid, or your check won’t clear, the transaction won’t

Bye, AutoPay. : r/tmobile

Jun 22, 2021Non-sufficient funds (NSF), sometimes called insufficient funds, describe when you don’t have enough money in your account to cover an expense. You may see a non-sufficient funds notice if you What is the best way to manually add a bank account? – Quora

Source Image: quora.com

Download Image

What’s an NSF Fee and Why Do Banks Charge It? | Credit Karma Jun 22, 2021Non-sufficient funds (NSF), sometimes called insufficient funds, describe when you don’t have enough money in your account to cover an expense. You may see a non-sufficient funds notice if you

Source Image: creditkarma.com

Download Image

UOB One Account (Savings Account) Review 2023 – MoneySmart Blog Jul 8, 2022Banks and credit unions charge nonsufficient funds, or NSF, fees when you don’t have enough money in your account to process a transaction. NSF fees can add up quickly, so it’s important to take steps to avoid them. Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors

Source Image: blog.moneysmart.sg

Download Image

Different Types Of Bank Accounts | PDF May 1, 2023You haven’t opted-in to overdraft protection, so the check bounces and your bank charges you $34 — the average cost of an NSF fee. Your account balance is now $66 ($100-$34). Let’s look at the

Source Image: slideshare.net

Download Image

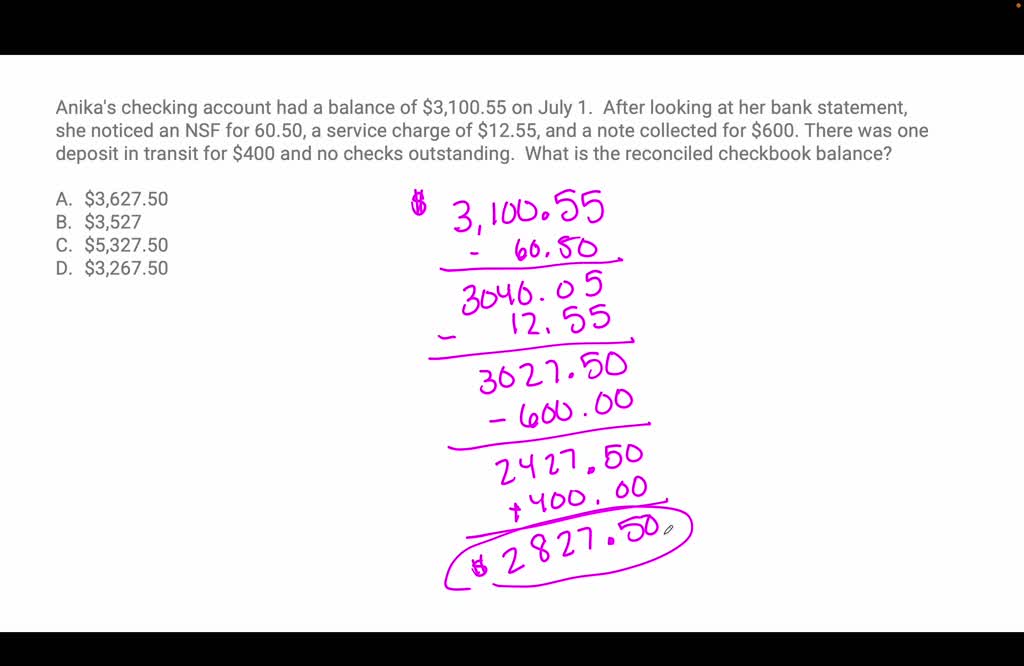

SOLVED: Anika’s checking account had a balance of 3,100.55 on July 1. After looking at her bank statement, she noticed an NSF for60.50, a service charge of 12.55, and a note collected Aug 16, 2023When some banks receive a check or ACH transaction for an account with non-sufficient funds, they’ll return the transaction unpaid and deduct an NSF fee—also known as an NSF charge—from the account. NSF fees vs. overdraft fees

Source Image: numerade.com

Download Image

Post-Exams][PSA] Best Savings Account for NSF. Bonus: Recommended Savings Account for Youths : r/SGExams NSF Checks on a Credit Report July 17, 2016 • 2 min read By The Experian Team Dear Experian, How long do non-sufficient funds checks (NSF’s) stay on your credit report? – LLS Dear LLS, A non-sufficient funds check may not appear on your credit report.

![Post-Exams][PSA] Best Savings Account for NSF. Bonus: Recommended Savings Account for Youths : r/SGExams](https://i.imgur.com/1ehZdXo.png)

Source Image: reddit.com

Download Image

Financial Accounting Notes | ACCT101 – Financial Accounting – SMU | Thinkswap Sep 28, 2023NSF fees are charges when a payment can’t be processed because you don’t have enough money in your account. If your bill can’t be paid, or your check won’t clear, the transaction won’t

Source Image: thinkswap.com

Download Image

What’s an NSF Fee and Why Do Banks Charge It? | Credit Karma

Financial Accounting Notes | ACCT101 – Financial Accounting – SMU | Thinkswap Jun 14, 2022The APR (which is the same as your interest rate) will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300. You see a non-sufficient funds (NSF) fee on your bank statement.

Different Types Of Bank Accounts | PDF Post-Exams][PSA] Best Savings Account for NSF. Bonus: Recommended Savings Account for Youths : r/SGExams Aug 16, 2023When some banks receive a check or ACH transaction for an account with non-sufficient funds, they’ll return the transaction unpaid and deduct an NSF fee—also known as an NSF charge—from the account. NSF fees vs. overdraft fees